straight life policy formula

A first-to-die joint life policy pays when the first person dies. Rate of depreciation.

Straight Line Depreciation Accountingcoach

Since the death benefit is 250000 the policy holder.

. Visit to learn more about uniform and non-uniform. Rate of depreciation can be calculated as follows. You can also talk to a Sun Life advisor.

Every calculation for other payment options. Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable.

CEO The Annuity Expert. A straight life insurance policy often known as whole life insurance. Melissa Toby age 36 bought a straight-life insurance policy for 80000.

Determine the cost of the asset. Joint life policies insure the lives of two or more people. Calculate the depreciation to be charged each year using the Straight Line Method.

A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. Depreciation Per Year is calculated using the below formula. Straight life policy formula Thursday June 9 2022 Edit.

Divide the product by 12 to calculate your monthly straight life benefit. A straight life policy sometimes called a straight life annuity is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Straight Life Insurance Calculator Straight Life Insurance Quotes Find The Best Life Insurance Coverage At The.

This policy can be used as an estate planning. A straight life annuity is tax-advantaged just as other annuities. The straight life option pays a monthly annuity directly to the retiree for life.

Straight life is the simplest benefit option offered by APERS. Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful. This is expected to have 5 useful life years.

Depreciation is calculated based on the fiscal years remaining. How to calculate the depreciation expense for year one. Depreciation Per Year Cost of Asset.

Rate of depreciation is the percentage of useful life that is consumed in a single accounting period. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

Only upon the death of the second. Straight line amortization is a method for charging the cost of an intangible asset to expense at a consistent rate over. A straight life insurance policy can also build cash.

A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used. The straight line calculation steps are.

On the death of the retiree the monthly payments. A survivorship life policy pays-. Calculate your annual straight life pension using your pension formula.

Bottle Feeding Moms Breastmilk Or Formula Feel More Judged Every Time They Pull Out A Bottle In Public Than Yo Breastfeeding New Baby Products Bottle Feeding

The Structure Of Glucose Structural Formula Pearson Education Anatomy And Physiology

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Straight Line Basis Definition

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Swaddling 101 How To Swaddle A Baby Swaddle Baby Swaddle Soft Blankets

Straight Line Persuasion Brutally Honest Review Tpm

Depreciation Formula Calculate Depreciation Expense

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Slope Intercept Form Finding Slope Ten Fantastic Vacation Ideas For Slope Intercept Form Fin Slope Intercept Form Slope Intercept Point Slope Form

Crunch Bliss Sixpack Attack Fitness Exercise Fitness Motivation

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Write An Effective Scholarship Motivation Letter Creative Living Abroad Motivational Letter Lettering Writing A Persuasive Essay

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

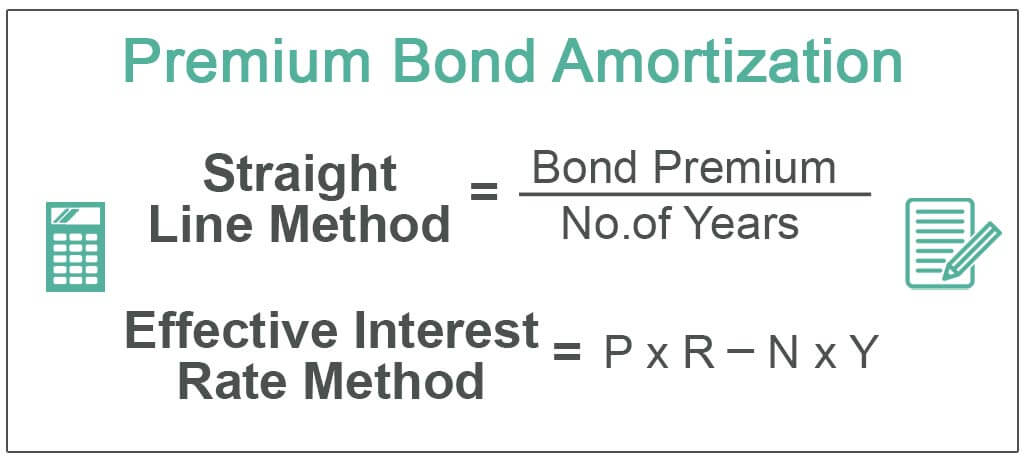

Amortization Of Bond Premium Step By Step Calculation With Examples

Berina Nize Hair Rebonding Neutralizing Cream Plus Hydrolyzed Silk 500ml 8850398400102 Ebay In 2022 Hair Cream Cream How To Apply